×

![]()

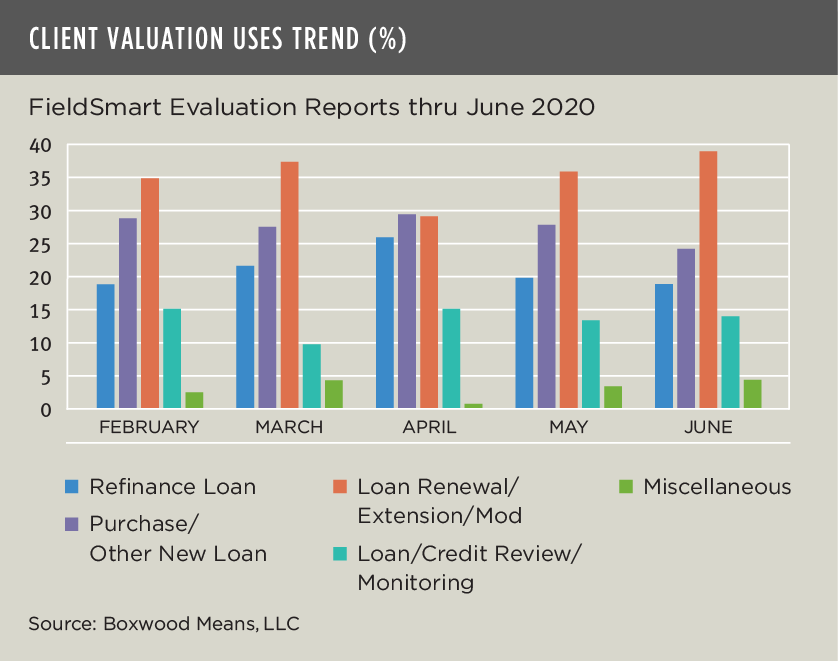

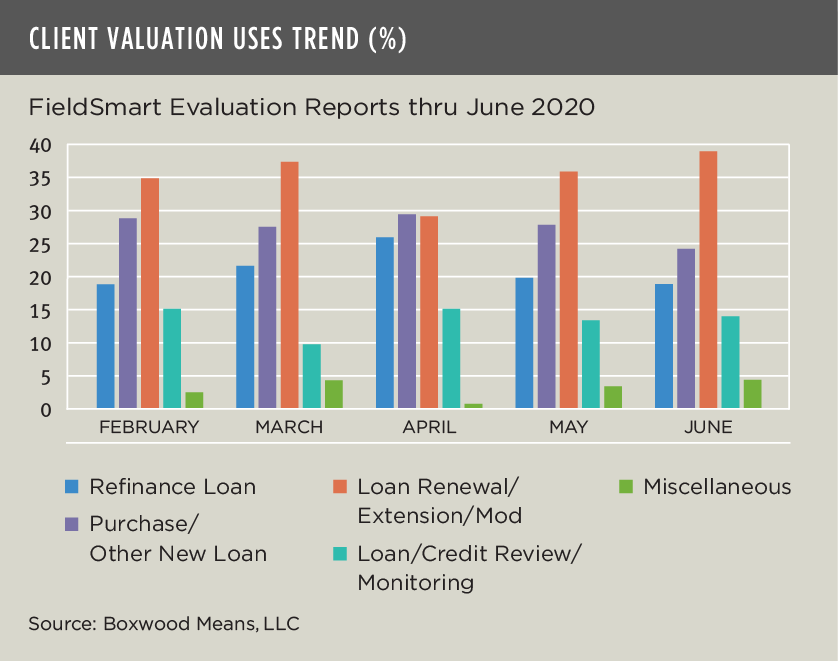

Small-balance CRE loan extension and modification actions by banks reached a five-month high during June while loan originations took another hit.

Boxwood's latest analysis of procurement data on clients’ use of Boxwood's FieldSmart Evaluation reports signals further distress ahead for borrowers of small-balance commercial loans as the severity of the pandemic increases in large swaths of the country.

Key takeaways from our June analysis include:

- FieldSmart orders for loan renewals, modifications and extensions increased 2.9% to 38.9% of all valuation reports and rose for the third consecutive month (see the nearby graph). While such subsequent or non-financial transactions are a routine use of valuations over the lifecycle of CRE loans, the mounting workload of these actions reflects the troubled debt situation experienced by many small business borrowers and investors.

- Purchase and other new loan activity dropped by a substantial 3.5% as sales transaction volume faded. Valuation requests for loan originations dropped to 24.2% of all orders, the lowest percentage in five months and nearly 10% below the level last fall.

- Orders for refinance loans eased 90 basis points (bps) to an 18.8% share of the total, nearly matching the level from February. Refinance loan activity peaked in April at 26.1% of all valuation orders after the 10-Year Treasury rate dropped roughly 40 bps between March and April to the 0.6% range.

- Loan/credit review and portfolio monitoring uses ticked up 70 bps during June to 13.9% of all orders.

As national small-cap CRE market conditions certainly weaken in the months ahead, we expect that monitoring of portfolio loans will increase with heightened concerns over loan performance generally and, more specifically, loans that remain delinquent after forbearance periods expire. Indeed, perhaps as a harbinger of things to come the June figures showed an increasing number of valuation uses supporting workouts and foreclosures in the growing Miscellaneous category.

Check these blog pages later this month for a report on small-cap market conditions updated through second quarter. Our next update of FieldSmart order procurement data will be published in August.

Or sign up for our newsletter to be notified when this research is published.

Randy Fuchs

Randy Fuchs