×

![]()

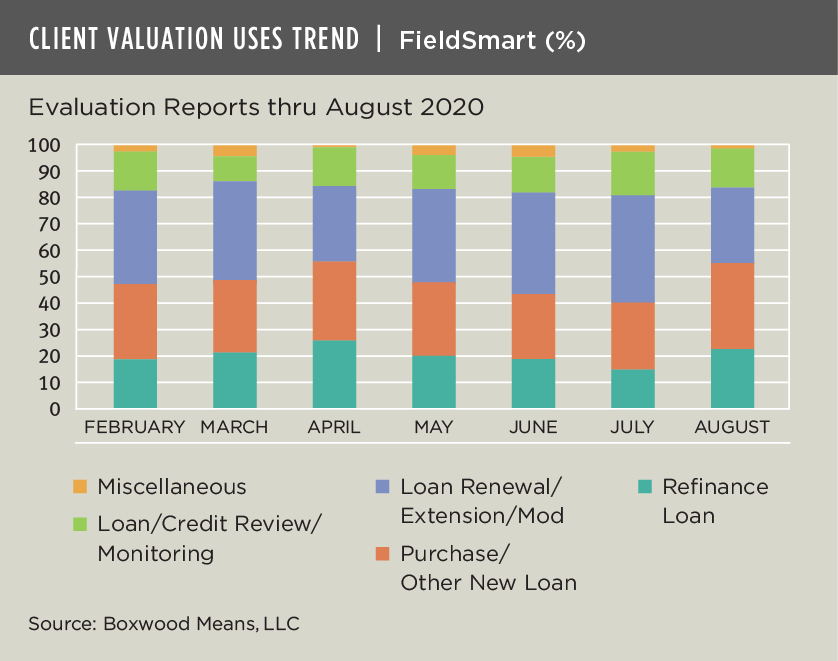

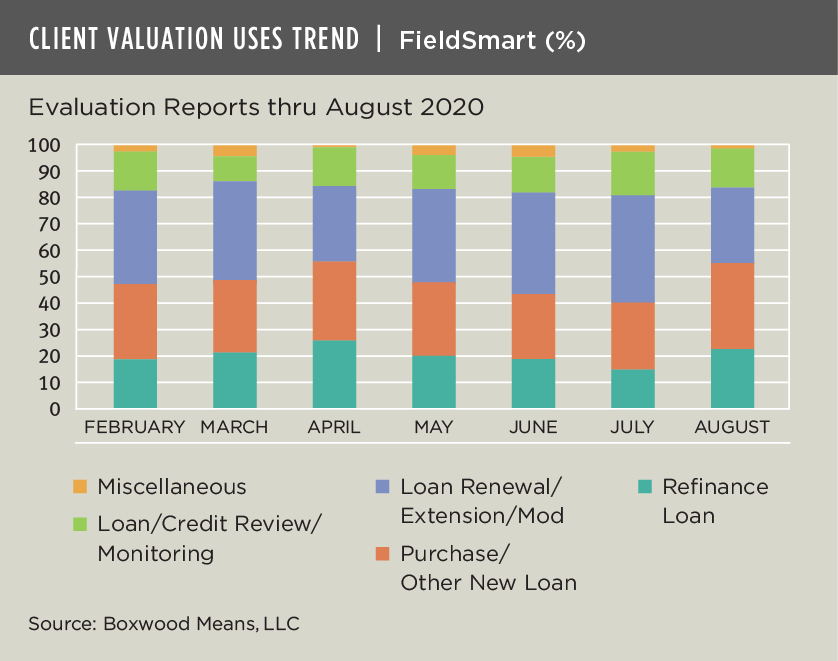

Main Street businesses and small property owners increased their demand for new small-balance commercial loans last month according to Boxwood's latest procurement data on FieldSmart Evaluation reports among clients.

Favorable interest rates proved to be stimulative for borrowers, as the 10-year yield bottomed out at 0.52% in early August – the lowest level since March – before re-inflating to .72% by month end.

The rebound in new loans arises even as many commercial banks shift from a focus on loan growth to loan resolution in the wake of a pandemic-induced spike in loan delinquencies and deferrals.

Key takeaways from our August analysis include:

- FieldSmart orders for purchase and other new small CRE loans jumped over seven percentage points to 32.6% of the month's total, the highest level in at least six months that predated the COVID outbreak. See the nearby graph.

- Valuation uses for refinance loans also rallied by more than seven percentage points to a 22.3% share, the highest amount since April.

- Loan renewals, modifications and extensions dropped by over 10 points to 29.1% to the lowest level in four months. The dip halted a seemingly durable and rising monthly trend in bank activity devoted to loan renewals and deferments, and may be partially explained by the diversion, likely temporary, of lender resources to the increased requests and applications for new loans.

- Orders for loan/credit reviews and portfolio monitoring gave back a few points to 14.7% of all valuation uses, though this share remained consistent with the longer-term trend.

Despite the elevated borrower demand for new small-balance loans, bankers know that existing loan quality within their portfolios is eroding for certain types of small CRE assets owned by financially stressed small business owners. Criticized assets are growing, and unfortunately, it is only a matter of time before more banks join others that have already increased reserves and charge-offs.

Boxwood's commercial evaluations and restricted appraisals are key, cost-effective tools for our bank clients when updating collateral values and mitigating credit risk given current market uncertainties.

Randy Fuchs

Randy Fuchs