The fallout from the “higher for longer” interest rate regime is playing out as anticipated in the commercial real estate world. Many CRE borrowers are handcuffed by high debt costs and face serious refinancing risk as loans mature. By some estimates, this wall of maturities is expected to total more than $2 trillion through 2027. As a result, among other lenders commercial banks in particular confront a rising tide of troubled CRE loans.

Rooted in Federal guidance in the aftermath of the GFC, regulators last year encouraged banks once again to work with distressed CRE borrowers in light of today’s challenging economic and capital market conditions. Last time, this “extend and pretend” strategy largely panned out because debt became more available and less costly once the Federal Reserve began cutting interest rates and property cash flows improved. The same playbook might again help lenders avoid losses, but replicating the sweeping and positive outcome of the past era is questionable given the stickiness of today’s inflation and high rates.

Given Boxwood’s primary business focus on CRE property valuations and our support for hundreds of banks (among other lenders), we dive into some of the details of bank CRE lending and loan performance here for the first time. Highlights of our analysis of Q1 CRE loan data on 4,312 banks sourced from BankRegData include the following:

-

CRE Lending Crept Higher. Banks may be extremely cautious, but they are not entirely sitting on the sidelines. Non-owner Occupied CRE loan volume (income-producing collateral excluding multifamily) ticked up 0.3% sequentially, or an incremental $3.86 billion, to $1.74 trillion in total debt outstanding. Certainly, this is a modest production increase compared, for instance, with the average 2.3% gain during 2022. Nevertheless, Q1’s volume was a favorable comp to the flat change of a year ago. Better yet, Owner-Occupied CRE loans, those business owner loans backed by real estate that typically represent slightly less risky investments for lenders, jumped 1.1% last quarter, or $7.20 billion, to a total balance of $652.5 billion. Lastly, Multifamily loans, also traditionally a relatively lower-risk proposition, rose 1.5% and $9.1 billion – this segment’s best showing in five quarters – for a total $620.20 billion of bank loans outstanding.

-

×

![]()

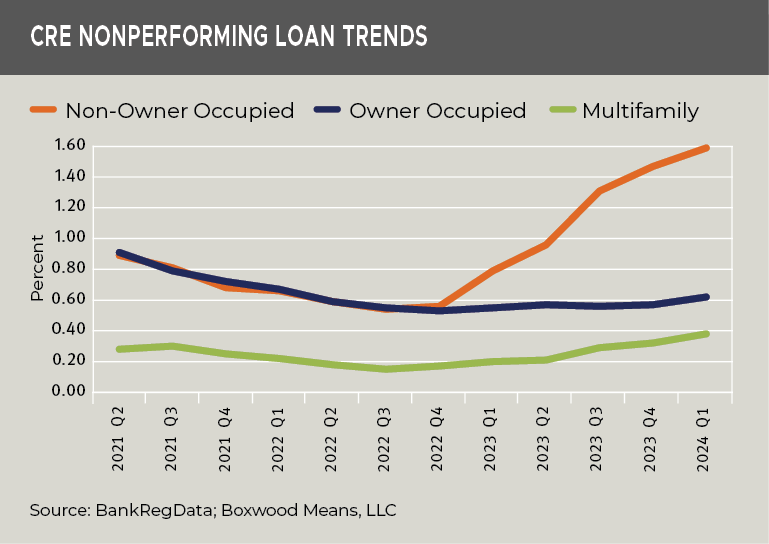

Nonperforming CRE Loans Mounted. The rising trend in CRE nonperforming loans (NPLs), defined as loans that are either 90+ days past due or nonaccrual, underscores the sobering and urgent task facing many commercial banks. The trajectory of Non-Owner Occupied CRE NPLs is particularly concerning: this segment reached a total NPL sum of $18.7 billion in Q1, up 12 bps to 1.59% of the total $1.17 trillion of Non-Owner Occupied debt outstanding. See the worrying “hockey stick” trend line nearby, largely inflated by the doubling of the segment’s NPL rate (0.79%) in a year’s time. On the other hand, the increase in Owner-Occupied NPLs was more subdued, rising 5 bps sequentially and 7 bps YOY to 0.62% (totaling $4.0 billion), less than one-half the rate of the Non-0wner Occupied segment. Finally, Multifamily NPLs were lower still at 0.38% (totaling $2.4 billion), though Multifamily nonperforming debt climbed at a faster and somewhat disquieting clip, i.e., up a noteworthy 18 bps YOY.

-

×

![]()

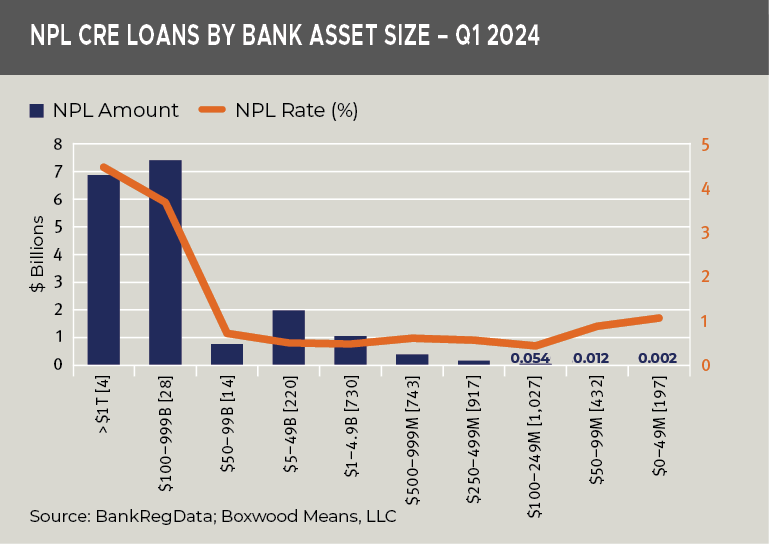

NPLs Were Heaped among the Biggest Banks. Though the bank wide NPL average of 1.59% in the Non-Owner Occupied segment is concerning, it’s worth mentioning that roughly three quarters, or $14.3 billion of the total $18.7 billion of bad debt, was concentrated among the 32 largest banks of $100 billion assets or more. As the nearby graph illustrates (note the number of institutions in brackets), the four banks with assets above $1 trillion suffered an NPL rate of 4.47% while 28 institutions between $100-$999 billion were burdened with a rate of 3.68%. These rates are worrisome, and it wouldn’t be surprising if, in addition to certain struggling large-cap retail and multifamily assets, a weighty portion of this sizable, billion-dollar troubled debt stems from some big, increasingly distressed CBD office building loans for which only the largest banks typically can muster the funding. Excluding those two biggest bank asset classes, the remaining 4,280 banks carried a much lower average NPL figure of .66%. That being said, the 629 banks comprising the two smallest asset classes held relatively higher rates of 0.88% and 1.07%, respectively. Local community banks may be vulnerable to a ramp up in NPLs as the year unfolds, since they often carry a disproportionately high concentration of CRE loans on their balance sheets.

-

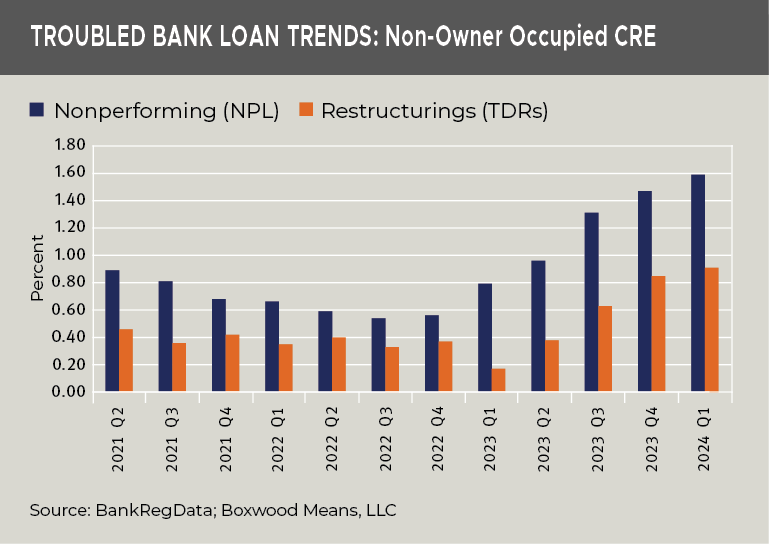

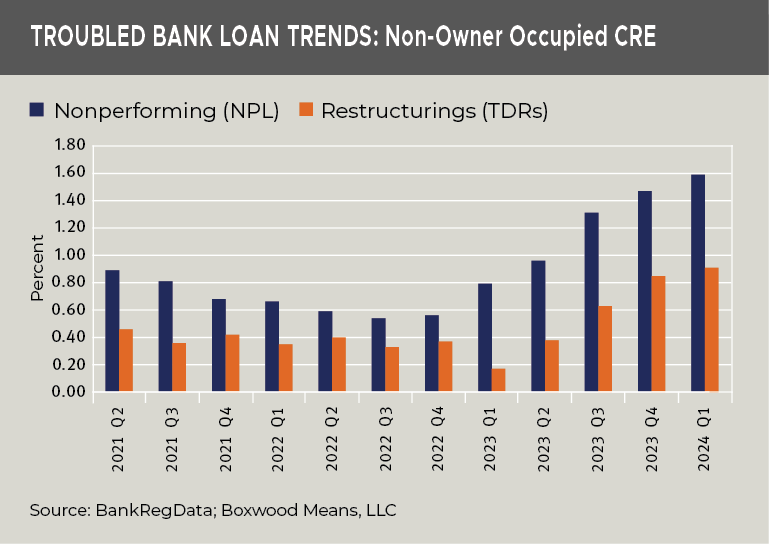

Restructurings Reved Up. As NPLs have accelerated, banks in turn have quickened the pace of restructuring or modifying troubled CRE loans in a programmatic effort to provide borrowers with payment relief. Hence, Troubled Debt Restructurings (TDRs) for Non-Owner CRE loans rose 6 bps to 0.91%, or a total of $10.7 billion, by far the highest percentage (and amount) among the three CRE categories. (See the nearby graph showing the steep incline in NPLs and TDRs for this segment.) Q1 restructurings for the other two CRE groups were lower. For example, TDRs for Owner-Occupied CRE have been relatively steady over the last couple of years – reflecting more so the stability of owners’ businesses than the real estate – with the rate actually dipping 2 bps to 0.31% (totaling $2.0 billion). While the Multifamily TDR rate is presently in this same ballpark, at 0.27% after a 5 bp-increase (and tallying $1.7 billion), this sector’s trend is less auspicious: i.e., the TDR rate has more than doubled YOY. It’s likely that higher than average vacancy rates associated with a monumental surge in new, sizable apartment complexes over the past two years has impaired some of these loans.

×

![]()

Lenders are clearly gambling for time, i.e., that modifications and extensions offer both lenders and borrowers enough breathing room for lower rates (and more disinflation) to eventually kick in, along with a recovery in diminished property income and asset valuations. Yet if time is not on their side, “extend and pretend” tactics will almost certainly backfire as many restructurings eventually fall apart, and lenders then have little recourse other than to sell an even larger pile of impaired loans at a loss or foreclose and sell the hard assets outright. Unfortunately, absent greater proactive measures by banks to reduce their exposure while higher rates linger, the troubled loan trends within institutional CRE portfolios are only likely to intensify.

Watch these pages for updates on bank CRE loan performance as the year progresses.

Randy Fuchs

Randy Fuchs