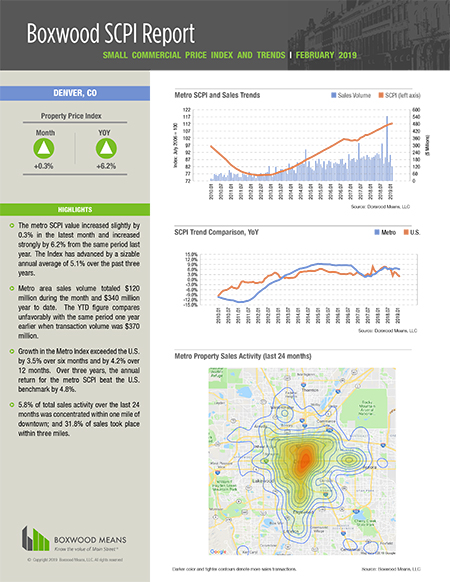

Boxwood's popular Small Commercial Price Indices (SCPI) have been expanded into a wholly new series of metro-level reports designed to shed new light on the dynamics of the small-cap CRE investment market for credit analysts, underwriters, and asset and portfolio risk managers. The launch of these reports coincides with the growing need among analysts for valuable data and analytics late in the cycle as market risk has heightened in small-balance lending and investment.

These Metro SCPI Reports, running 2-3 pages in length and updated monthly, cover 125 commercial and 45 multifamily markets and are replete with tables, graphs and bite-sized commentary that deliver key market sales volume metrics and price trends about the massive small commercial property and loan markets under $5 million in value.

The reports answer the following types of questions:

- How much have asset prices increased (or decreased) in the metro over recent months, or during the last year or more?

- Is metro price growth outpacing the U.S. average? By how much?

- Is the metro’s price index above or below the previous cyclical peak, and by what percentage?

- How volatile are metro prices over time and compared with the U.S.?

- What is the metro’s rank in price growth and price volatility versus the other 125 U.S. metros?

- What is the metro’s total sales volume, and how is it trending?

Such answers offer analysts unique insights into investment risk for the metro as well as relative to other U.S. markets.

Any number of the 125 Metro SCPI Reports can be obtained through annual subscription. Click on the nearby image to download a sample report.