Despite a more optimistic outlook over the summer, spurred by expectations of a September interest rate cut, hopes for a quick rebound in capital market activity were tempered as Q3 commercial real estate sales volumes fell, and cap rates ticked higher. The slowdown in transactions was broad-based but more pronounced in the small-cap sector compared to the wider market. Even though the U.S. economy continues to grow, and inflation is easing, uncertainty lingers around the pace of recovery in the CRE capital markets.

Key findings from Boxwood’s analysis of CoStar’s Q3 sales data include:

×

![]()

-

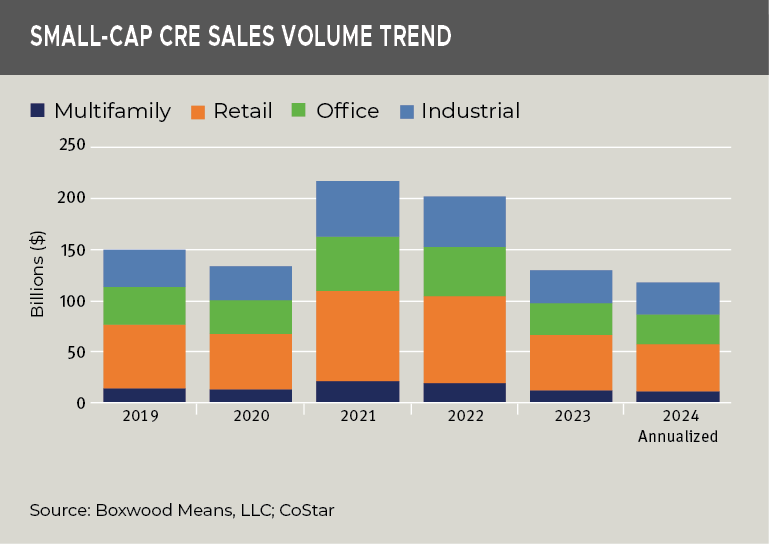

Small-cap CRE transaction volume declined. As anticipated, property sales this year have been underwhelming. Transactions involving small deals (under $5 million) fell by 23.2% in Q3 to a preliminary total of $26.4 billion, compared to Q2. All major sectors saw declines, with retail sales dropping the most at 33.4%, followed by mid-teen declines in office, industrial, and multifamily sales. (Refer to the graph nearby.) Total sales for the year through September amounted to $88.4 billion, trailing last year’s pace by a smaller margin of 8.8%. However, when compared to the same period in 2019, the year-to-date (YTD) deficit widens to 16.5%, and versus 2022 when the post-pandemic market reopened, the gap grows to 41.6%.

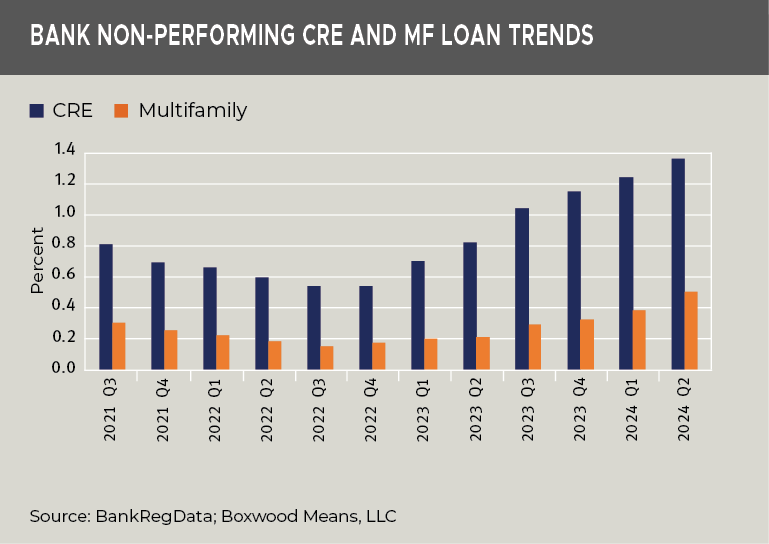

A significant factor behind this decline is that small business owners and investors often depend on U.S. banks for financing property purchases. While banks modestly increased CRE and multifamily loans in Q2 by 0.5% and 2.5% year-over-year (YOY) to $2.5 trillion, many deals are not financially viable due to high borrowing costs and relatively sticky property valuations in the small-cap space. Additionally, banks are grappling with rising nonperforming loans (NPLs) and charge-offs, further tightening credit availability. (Refer to the NPL trend in the graph nearby.)

×

![]()

-

General market sales saw a smaller decrease. In contrast, overall market sales volume totaled $164.2 billion in Q3, reflecting a modest 3.4% dip compared to the previous quarter and a 5.9% drop YOY. Larger property owners have successfully accessed a resurgent CMBS market, bolstered by floating-rate loans and a shift to five-year conduit loans, which have offered sponsors more flexibility in an evolving interest rate environment.

-

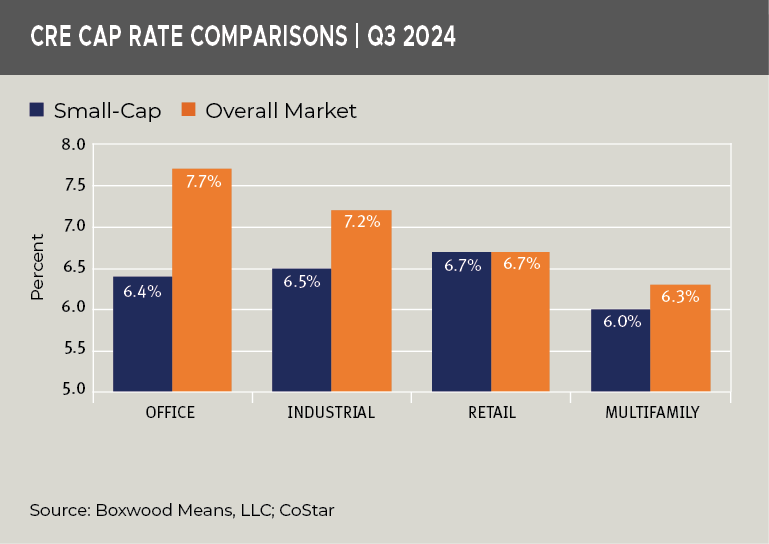

Cap rates increased slightly, but so did prices. Cap rates for smaller properties inched up in Q3. Office cap rates rose by 20 basis points (bps) to 6.4%, while industrial and retail sectors saw increases of 10 bps, reaching 6.2% and 6.5%, respectively. Multifamily cap rates held steady at 6.0%. Though cap rates have risen by 40-50 bps YOY across all sectors, they remain close to 2019 levels, before inflation and high interest rates became factors.

As seen in the graph nearby, Q3 cap rates in most sectors continue to reflect lower risk compared to the overall market, even as both sectors have experienced similar YOY expansions.

Meanwhile, prices for small-cap properties under 50,000 sq. ft. rose by low single digits sequentially, with a YOY increase ranging between 2.4% and 2.9%. Despite the higher interest rate environment that began in Q1 2022, low transaction volumes combined with consistent investor demand have helped buffer small-cap property values. In fact, median sales prices for small CRE assets have risen by an average of 30% across the four major property types since early 2020. In Q3, retail property prices averaged $239 per square foot (psf), followed by office ($200 psf) and industrial ($151 psf). Prices for small multifamily buildings (5-40 units) stood at $157 per unit.

×

![]()

For context, rising interest rates typically lead to an increase in cap rates, which, in turn, would be expected to lower property prices. While interest rates are a key factor in cap rate movements, other elements also influence cap rates and property values. We argue that the inverse relationship between cap rates and property values may apply more directly to the large-cap market than to smaller properties. The small-cap market, despite traditionally higher perceived risk, has proven to be more stable due to its favorable fundamentals—such as low supply, stable demand, and tight vacancy rates—as well as a base of investors who tend to hold onto their properties for the long term.

Given these factors, and with the expectation that future interest rate cuts could ease the credit crunch for banks, we believe small-cap properties represent a solid opportunity for a strong rebound in 2025.

Randy Fuchs

Randy Fuchs