Alarmingly, the sum of troubled non-performing multifamily loans held by banks has surged. Closely following this loan distress is a growing wave of early-stage delinquencies that will likely compound problems for multifamily portfolios in the near future despite banks ramping up efforts to mitigate risks.

The causes behind this rising delinquency are well known. As with commercial real estate loans in general, elevated debt costs have made refinancing multifamily (MFR) loans more difficult for borrowers, while banks have tightened credit. Additionally, a record influx of new apartment supply—totaling an estimated one million units over the past two years—has disrupted market balance, leading to slowing rent growth, rising vacancies, and weakening demand.

Below are key challenges facing bank-held multifamily portfolios, based on Q4 Call Report data compiled by BankRegData.

-

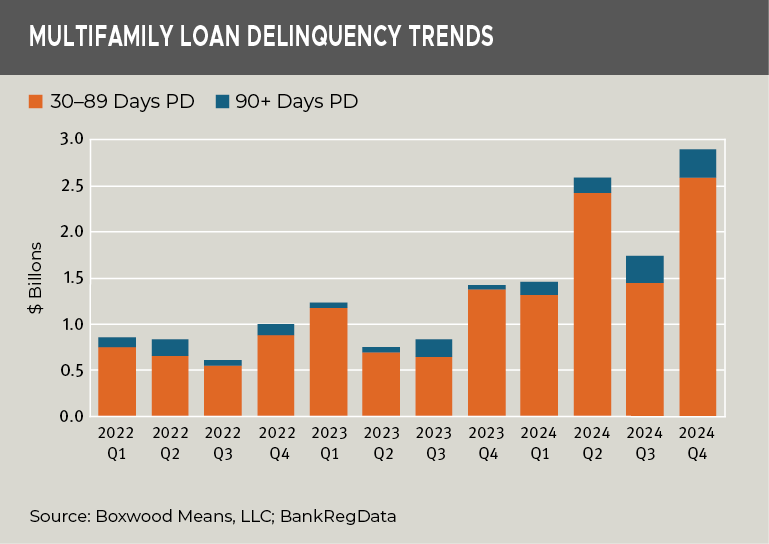

Delinquencies Are Rising Rapidly. Total delinquent multifamily loans have reached a 10-year high, climbing to $8.5 billion, or 1.35% of total MFR loan portfolios—up 38 basis points (bps) for the quarter and a staggering 80 bps year-over-year (YOY). The total dollar value of these problem loans has skyrocketed 153.5% over the past year.

×

![]()

-

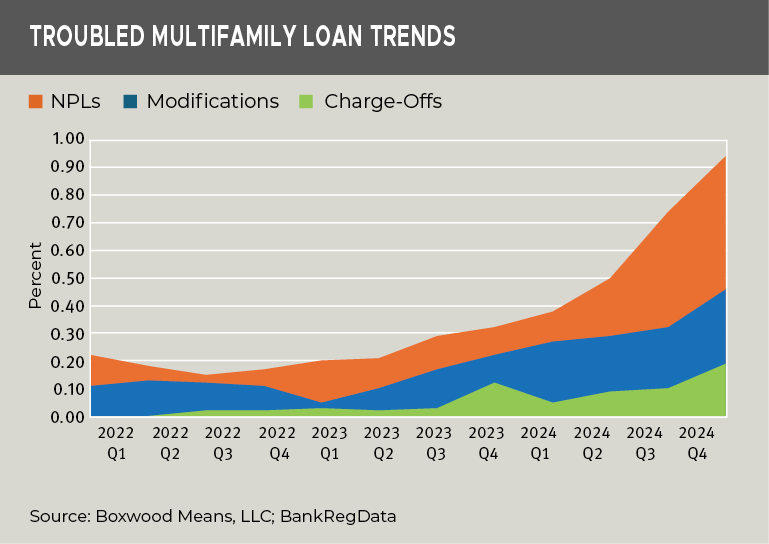

Non-Performing Loans (NPLs) Are Escalating. The most concerning segment—loans that are 90+ days past due or on nonaccrual status—nearly tripled YOY, now standing at $5.9 billion (0.94%). For perspective, the NPL rate in Q4 2022 was just 0.17%.

-

Early-Stage Delinquencies Signal More Trouble Ahead. Loans that are 30-89 days past due (but still accruing interest) indicate further risks. Over $1 billion in additional delinquencies accumulated in Q4, doubling the quarterly delinquency rate to 0.41% and bringing the total to $2.6 billion. As shown in the accompanying graph, this spike in short-term delinquencies (orange) significantly outpaces the more gradual rise in 90+ day delinquencies ($307.4 million, or 0.05%). Many of these early-stage loans may transition to NPLs in the coming quarters.

-

Banks Face an Uphill Battle in Risk Mitigation. Amid rising distress, banks have intensified efforts to contain losses. As depicted in the graph, Q4 loan modifications (blue) rose 44% for the quarter and 119.5% YOY, reaching $2.9 billion (0.46% of total MFR loans). Loan charge-offs (green) also surged, increasing 68.8% in Q4 to $304.2 million, the highest level since Q4 2011. Even so, neither of these segments have kept pace with the torrid growth in NPLs (orange).

×

![]()

These trends underscore a troubling reality: the rapid growth of distressed MFR loans is outstripping banks' current mitigation strategies. Even with aggressive credit monitoring and intervention, financial institutions will likely face heightened risks including increased loan loss reserves (which limit funds for new lending), reduced interest income and profitability, and intensified regulatory scrutiny.

On behalf of numerous bank clients, Boxwood Means operates collateral monitoring programs such as building inspections and asset valuation updates that meet the guidance of regulators.

Randy Fuchs

Randy Fuchs