Recent revisions to the property appraisal requirements in the SBA’s current Standard Operating Procedures (SOP) guidance document give with one hand and take away from the other. That is, borrowers can save sizable dollars for certain uses of 7(a) loans, but the new requirements are also more costly for other loan purposes.

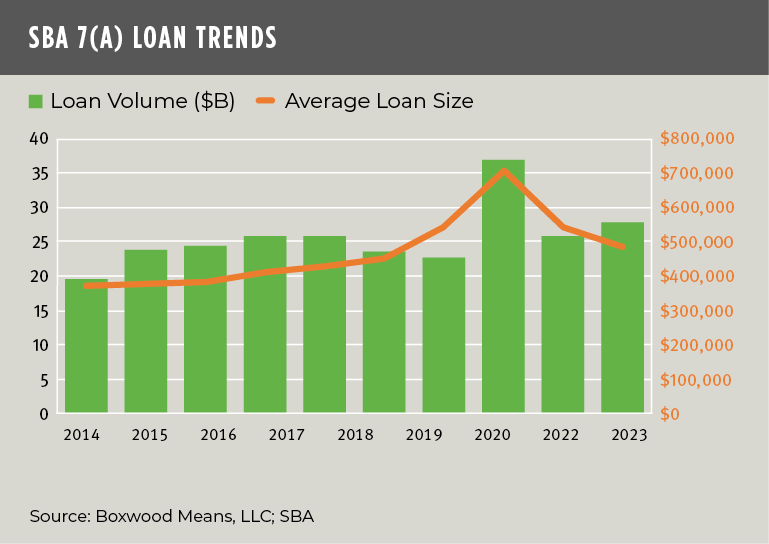

When mandated, commercial real estate property appraisals can be quite expensive for SBA 7(a) borrowers, especially since the fees can be very high relative to the modest size of these loans. After all, the average 7(a) deal size last year was just $485,000, and nearly 70% of these loans were small-ticket deals of $350,000 or less.

The demand for these loans is big business since they are often the only recourse for small business owners seeking funds. Overall, SBA approved more than 57,300 7(a) loans worth a whopping $27.8 billion during FY 2023 – a 7.5% increase YOY and the second largest approval amount in 10 years (see the nearby graph). Small business owners typically deploy SBA-backed 7(a) loan proceeds for multiple purposes, from purchasing and/or improving real estate to buying an existing business, equipment, inventory, or simply supplying working capital among other uses.

×

![]()

Unsurprisingly then, these 7(a) loans are very popular for borrowers who have special circumstances and funding needs. Less historically popular are the upfront appraisal fees ranging from roughly $2,500 to $4,000 when buying CRE property or pledging owned real estate with a personal guaranty.

Unfortunately for these 7(a) borrowers, the latest SOP (Version 50 10 7.1) issued last November tightens the reins on appraisal requirements in one way. But it also loosens them in another. First the bad news: a USPAP appraisal is now an outright requirement involving the acquisition, refinance, or improvement/construction of CRE property regardless of loan size. In the previous SOP version, a more abbreviated and cost-effective form of appraisal, specifically a commercial evaluation, was permissible in lieu of a USPAP appraisal for such CRE-related purposes on 7(a) loans under $500,000, or below $1,000,000 for owner-occupied CRE. Now, there’s no wiggle room – it’s a USPAP appraisal, full stop.

However, the second change to the SOP is more borrower friendly. That is, when a borrower uses non-commercial or commercial real estate as supplemental collateral along with a personal guaranty, SBA no longer requires a USPAP appraisal. In fact, in these specific cases, the SOP states that SBA has “no specific appraisal requirements” and, importantly, that applies to 7(a) loans of any size.

In other words, when a 7(a) borrower pledges real estate collateral with their personal guaranty, it’s at the discretion of SBA lenders whether to require an appraisal or not. Expect that lenders will have differing internal appraisal and underwriting guidelines that address this question. Some will insist on a full appraisal and others may accept an evaluation. Also, in some cases a recently completed appraisal or evaluation may be sufficient.

With today’s uncertain market conditions though, we expect that out of an abundance of caution lenders will at minimum require an evaluation on new 7(a) loans that are personally secured along with supplementary real estate collateral. And when they do so, borrowers luck out with a cost savings of as much as $2,000 with a commercial evaluation versus a USPAP appraisal.

A few national firms like Boxwood Means specialize in performing commercial evaluations that represent an abbreviated form of an appraisal (including a property inspection), are compliant with FIRREA, and follow the Interagency Evaluation and Appraisal Guidelines issued by the federal oversight agencies for commercial banks and credit unions.

By the way, evaluations are not a secret weapon – their use is actually widespread within the industry. For instance, Boxwood performs commercial evaluations (under our FieldSmart brand) supporting loan originations, credit underwriting, renewals, and portfolio monitoring among other purposes for 300 banks, credit unions, and private lenders nationwide.

So, SBA 7(a) lenders that swap out USPAP appraisals for commercial evaluations – when acceptable – are maximizing the appraisal cost savings for their clients on funding that is often vital to the financial future of many Main Street businesses.

Randy Fuchs

Randy Fuchs