The Small Business Administration’s (SBA) capital programs delivered impressive results in 2024, helping mitigate a broader decline in small business lending by banks. Among these, the SBA’s flagship 7(a) loan program had an exceptional year, driven by innovations aimed at streamlining the funding process.

×

![]()

By the Numbers

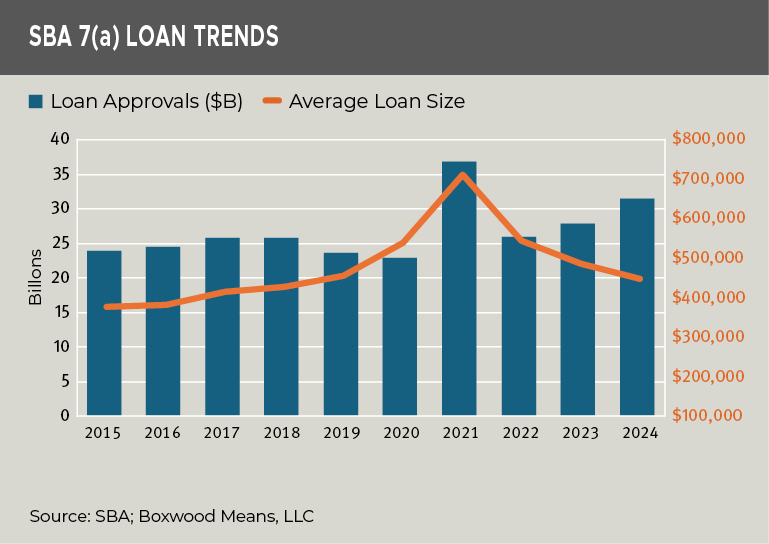

In fiscal year 2024, the SBA approved $31.5 billion in 7(a) loans, marking a 13.2% year-over-year (YOY) increase in dollar volume. This is the second-largest amount in the past decade. The number of loans approved reached 70,200, the highest count in over 15 years, with an average loan size of $448,400 — a modest decrease from previous years. (See the accompanying graph.)

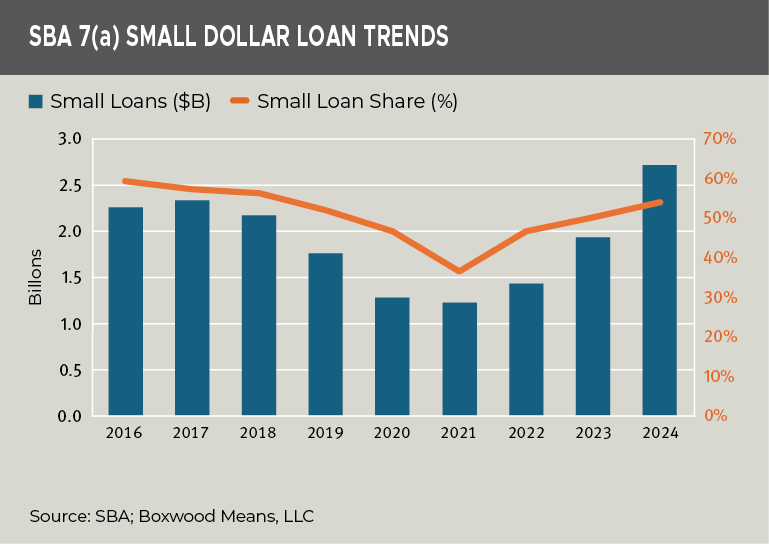

The year’s 22.5% increase in loan count reflects the program’s expanded reach, the efforts of participating lenders, and the surge in new business startups following the pandemic. This growth also fueled an increase in the 7(a) loan portfolio, which reached an unpaid principal balance (UPB) of $116.3 billion by year’s end. Notably, entrepreneurial demand for the smallest loans within the program played a significant role. Over half (54.2%) of all 7(a) loans—more than 38,000 — were approved for amounts under $150,000. The aggregate value of these small loans, at $2.7 billion, represented a whopping 41% YOY increase. (See the accompanying graph.)

×

![]()

Speed and Simplicity Drive Growth

Several key policy changes contributed to the rapid expansion of the smallest 7(a) loans. Streamlined lending criteria, simplified underwriting, and revised guidelines removed previous barriers, making the process faster and more accessible for lenders and borrowers alike.

The flexibility of 7(a) loans to address a variety of business needs also contributed to their popularity. Loan proceeds can be used for diverse purposes, including acquiring or improving commercial real estate, supporting working capital, purchasing equipment, furniture, and fixtures, or even acquiring a business. This adaptability has enabled the SBA to fill gaps in credit availability left by banks.

Aligning Property Valuations with Loan Size

The principles of speed and simplicity extend to the way lenders manage required property valuations. Lenders are encouraged to align the type and cost of valuations with the size of the loan. For example, when 7(a) loans are used for acquiring or improving commercial real estate (up to $5 million under the program), lenders must obtain a full USPAP appraisal.

However, for loans intended for non-commercial real estate purposes, where real estate collateral and a personal guaranty are often pledged, lenders have the option to procure either a full appraisal or a commercial evaluation.

Commercial evaluations, such as those provided by Boxwood Means, offer significant advantages. They are faster to produce, much less expensive than full appraisals, and align well with the SBA’s goals of greater efficiency, particularly for smaller loans. Evaluations enhance borrower experience and support the program’s objectives of streamlining lending for small businesses.

Conclusion

The SBA’s 7(a) program demonstrated remarkable adaptability and growth in 2024, buoyed by strategic policy changes that prioritized speed, simplicity, and efficiency. By addressing the unique needs of small business borrowers and lenders, the program has strengthened its position as a vital resource for fueling entrepreneurial growth and economic resilience into the new year.

Randy Fuchs

Randy Fuchs