As high inflation and fears of a recession whip through the canyons of Wall Street and Main Street alleyways, stable small-cap commercial real estate market leasing trends have at least temporarily repelled the prophets of doom.

The small business economy is certainly in flux. According to a Q2 CNBC/Survey Monkey Small Business Survey, a majority of small business owners faced big challenges in hiring, rising material and employee costs, and supply chain disruptions. Moreover, 80% of small business owners were convinced that the U.S. economy will fall into recession this year.

×

![]()

That last headline overshadowed other survey results that illuminated the resiliency and native optimism of small business owners. For instance, nearly 50% of the owners expected their core business products and services to increase over six months, and roughly 80% anticipated that their business revenues would either increase (43%) or stay the same (35%) over the next 12 months.

So, despite looming economic and financial risks, small business owners’ positive, can-do attitude translated to moderate gains in leasing commitments that kept the national small-cap CRE occupier market on an even keel at the midyear point.

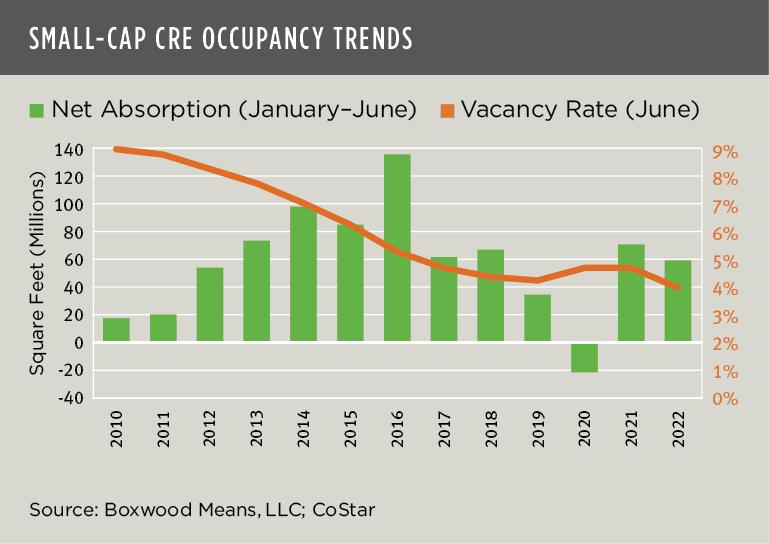

National small-cap CRE demand, which totaled 26.8 million sq. ft. across office, industrial and retail sectors during Q2, fell 16% along with a similar percentage decline for the first six months of 2022 compared with last year – an unfair comparison period, btw – as the market surged past the bitter, debilitating economic impacts of the pandemic. In fact, total net absorption for the first half of the year (58.8 million sq. ft.) was roughly on par with the results in the immediate years preceding the pandemic (2017-2019), reflecting the mature and slowing phase of this market’s cycle (see the nearby graph).

A similar pattern of moderate demand consistent with long-term averages is evident across industrial and retail sectors. Industrial net absorption (16.8 million sq. ft.) was off a sizable 54% at midyear versus the same six months of last year while retail (28.5 million) declined by 5%. But each sector’s six-month occupancy gains were in line with similar periods of leasing activity leading up to the pandemic. Small warehouses, distribution and manufacturing facilities benefited from a further shift to domestic (vs. global) production, while elevated consumer spending encouraged retailers to expand. Meanwhile, office demand (13.6 million) rebounded to more typical absorption totals with a six-month gain of 8% YOY that underscores the sustained viability of a small-cap office sector that relies heavily on less risky, short-term lease commitments by small business users.

Yet, what is most notable about the overall snapshot of the small-cap CRE occupier market at the half-way mark are the rock-bottom national vacancy rates (see the same graph). The overall average vacancy rate across office, industrial and retail buildings dipped 10 bps sequentially and 70 bps YOY to 4.0% – the lowest rate in at least 17 years according to Boxwood’s extract of CoStar data. Also, the aggregate availability rate, which combines physical vacancies with available subleases and temporarily popped at the height of Covid, narrowed to a new low of 5.3%.

Each sector contributed to the tight leasing conditions. The total industrial vacancy rate was unchanged at a historically low 2.9%, having dropped 70 bps from a year ago. Retail vacancies stood at a new nadir of 3.6%, down 20 bps from the previous quarter and 70 bps YOY. Even the much-maligned office sector showed solid improvement with a national vacancy rate that dipped 10 bps sequentially and 80 bps YOY to 6.5%, well within earshot of the all-time low of 6.1% recorded at midyear 2019.

The takeaways from this midyear report include:

- Generally speaking, the extraordinarily tight vacancy rates in small-cap CRE can serve as a buffer against potential reductions in operating income for small-time, private investors with holdings of multi-tenant buildings if a recession were to ensue.

- Taut commercial vacancies are likely sustainable because supply is historically low. Deliveries at midyear pro-rated for all of 2022 will be equivalent to last year’s total (6,600 buildings) but 25% less than the long-term average annual growth in new office, industrial and retail buildings.

- Small-cap CRE investment properties remain an attractive risk-return opportunity for small-balance lenders and investors because of the strong and enduring occupier market fundamentals. Over time, this smaller domain has proven to be less susceptible to wide fluctuations in absorption and vacancies than the CRE leasing market at large.

Stay tuned. We will update our latest small-cap CRE property prices and sales trends in an upcoming research blog piece.

Randy Fuchs

Randy Fuchs